The Indira Gandhi National Open University (IGNOU) offers a variety of courses across different disciplines. One of the prominent courses in the field of commerce is ECO-02, titled “Business Organization”. This course is part of the Bachelor’s Degree Program (BDP) and Bachelor’s Of Computer Application(BCA) and aims to provide students with a comprehensive understanding of the fundamental concepts, principles, and practices related to business organizations.

Course Objectives

The primary objectives of the ECO-02 course are to:

- Familiarize students with the various forms of business organizations and their functioning.

- Develop an understanding of the role of business in society.

- Enhance knowledge about business practices and the environment in which they operate.

- Equip students with the skills to analyze business situations and make informed decisions.

Introduction to IGNOU ECO-02: Business Organization

The course ECO-02 explores the different types of business entities, their organizational structures, and the economic contexts in which they function. This course is vital for anybody interested in a career in business or related professions because it gives students the skills they need to examine and comprehend the intricacies of corporate operations. ECO-02 equips students with the knowledge and skills necessary to make wise judgments and successfully contribute to the business world by covering subjects including marketing, human resource management, business ethics, and business finance.

Understanding the Importance of ECO-02 Short Notes:

1. Overview : Brief notes reduce an extensive amount of material into essential ideas and points. They offer a rapid and effective means of studying the key subjects in advance of the examination.

2. Focus on the Essentials: You may focus on each topic’s key elements by summarizing the available information. This guarantees that you cover the most relevant subjects and helps in setting priorities for your study materials.

3. Improved Retention: Taking quick notes requires you to take an active role with the information. Compared to passive reading, active learning promotes improved understanding and retention of knowledge.

4. Quick Reference: Brief notes are a quick reference that come in helpful when making last-minute changes. To fast brush up on specific concepts or formulas, you can swiftly scan them.

5. Time management: You may cover a lot of ground in less time by taking brief notes. This is very helpful if you don’t have much time to study before the test.

Most Repeated ECO-02 Important Questions for IGNOU BCA Exams Semester Wise :

BLOCK-1 of ECO-02

Ques. 1: Define Accountancy and Explain the Advantages and Objectives of Accounting

Definition of Accountancy:

Accountancy refers to the systematic and comprehensive recording of financial transactions pertaining to a business. It involves summarizing, analyzing, and reporting these transactions to oversight agencies, regulators, and tax collection entities.

Objectives of Accounting:

- Recording Transactions: To record all financial transactions systematically and chronologically in the books of accounts.

- Reporting Financial Results: To prepare financial statements (Income Statement, Balance Sheet, and Cash Flow Statement) that provide information about the financial performance and position of the business.

- Assessing Financial Position: To provide insights into the business’s assets, liabilities, and equity through the balance sheet.

- Decision Making: To supply relevant information to management and stakeholders for making informed business decisions.

- Compliance: To ensure compliance with financial regulations and legal requirements.

- Control: To assist in controlling the business’s resources by providing detailed information on costs, revenues, and profits.

Advantages of Accounting:

- Financial Information: Provides comprehensive and systematic financial information about the business.

- Decision-Making: Assists management in making informed decisions based on accurate financial data.

- Performance Evaluation: Helps in evaluating the financial performance and operational efficiency of the business.

- Legal Compliance: Ensures that the business complies with statutory requirements and financial regulations.

- Resource Management: Facilitates effective management of resources through detailed cost and profit analysis.

- Stakeholder Communication: Provides essential information to stakeholders, including investors, creditors, and regulatory bodies.

- Internal Controls: Strengthens internal controls by identifying discrepancies and implementing corrective measures.

Ques. 2: What Do You Understand by the Cost Concept and Dual Aspect Concept?

Cost Concept:

The cost concept, also known as the historical cost concept, states that assets should be recorded at their original purchase price, not at their current market value. This concept ensures that the recorded values of assets are objective and verifiable.

Advantages of Cost Concept:

- Objectivity: Ensures that asset valuations are based on objective and verifiable data.

- Simplicity: Simplifies the accounting process by using consistent and unchanging figures.

- Comparability: Facilitates the comparison of financial statements over different periods.

Dual Aspect Concept:

The dual aspect concept is a fundamental principle of accounting which states that every financial transaction has two equal and opposite effects. This concept forms the basis of the double-entry system of accounting, ensuring that the accounting equation (Assets = Liabilities + Equity) always remains balanced.

Advantages of Dual Aspect Concept:

- Accuracy: Ensures accuracy in the recording of transactions by maintaining a balanced accounting equation.

- Completeness: Provides a complete picture of the financial effects of transactions.

- Consistency: Promotes consistency in financial reporting.

Ques. 3: What Are a Double-Entry System and a Single Entry System?

Double-Entry System:

The double-entry system is an accounting method that records each transaction in at least two accounts, with equal debit and credit entries. This system ensures that the accounting equation (Assets = Liabilities + Equity) remains balanced.

Advantages:

- Accuracy: Reduces errors by ensuring that total debits equal total credits.

- Comprehensive: Provides a complete record of transactions, including both sides of the transaction.

- Financial Statements: Facilitates the preparation of accurate financial statements.

Single Entry System:

The single entry system is a simplified accounting method that records only one side of each transaction, typically focusing on cash receipts and payments. It is commonly used by small businesses with simple financial transactions.

Advantages:

- Simplicity: Easy to maintain and understand.

- Cost-Effective: Less expensive to implement and manage.

Ques. 4: What Is a Trial Balance? How Is It Prepared?

Trial Balance:

A trial balance is a statement that lists the balances of all ledger accounts at a particular point in time. It is used to verify that the total debits equal the total credits, ensuring the accuracy of the double-entry bookkeeping system.

Preparation of Trial Balance:

- List Account Balances: List all the account balances from the ledger.

- Separate Debits and Credits: Record debit balances in one column and credit balances in another.

- Calculate Totals: Calculate the total of debit and credit columns.

- Verify Balance: Ensure that the total of the debit column equals the total of the credit column.

Example:

| Account Name | Debit (Rs) | Credit (Rs) |

|---|---|---|

| Cash | 10,000 | |

| Accounts Receivable | 5,000 | |

| Inventory | 7,000 | |

| Accounts Payable | 4,000 | |

| Capital | 18,000 | |

| Revenue | 5,000 | |

| Expenses | 3,000 | |

| Total | 25,000 | 25,000 |

The totals of the debit and credit columns must be equal, indicating that the ledger accounts are correctly balanced.

Ques. 5: What Is a Cash Book and Its Types?

Cash Book:

A cash book is a financial journal that records all cash receipts and payments, including bank deposits and withdrawals. It serves both as a journal and a ledger.

Types of Cash Books:

- Single Column Cash Book: Records only cash transactions.

- Double Column Cash Book: Records both cash and bank transactions.

- Triple Column Cash Book: Records cash, bank transactions, and discounts.

Example of a Triple Column Cash Book:

| Date | Particulars | L/F | Cash (Rs) | Bank (Rs) | Discount (Rs) |

|---|---|---|---|---|---|

| 01/05/2024 | Cash Sales | 10,000 | |||

| 02/05/2024 | Bank Deposit | (5,000) | 5,000 | ||

| 03/05/2024 | Received from John | 2,000 | 100 | ||

| 04/05/2024 | Purchased Goods | (3,000) | |||

| Total | 4,000 | 5,000 | 100 |

Ques. 6: What Is a Bank Reconciliation Statement and Its Advantages?

Bank Reconciliation Statement:

A bank reconciliation statement is a document that reconciles the balance shown in the bank statement with the balance shown in the company’s cash book. It identifies discrepancies due to timing differences, errors, or omissions.

Advantages:

- Accuracy: Ensures that the company’s financial records are accurate and complete.

- Error Detection: Helps in detecting errors and discrepancies in the cash book and bank statement.

- Fraud Prevention: Assists in identifying unauthorized transactions or fraudulent activities.

- Cash Flow Management: Provides insights into the actual cash position of the business.

Example of a Bank Reconciliation Statement:

| Particulars | Amount (Rs) |

|---|---|

| Balance as per Cash Book | 10,000 |

| Add: Cheques issued but not yet presented | 2,000 |

| Less: Cheques deposited but not yet cleared | (1,500) |

| Less: Bank charges | (100) |

| Adjusted Balance as per Bank Statement | 10,400 |

Ques. 7: Write a Short Note on the Bill of Exchange and Promissory Note

Bill of Exchange:

A bill of exchange is a written, unconditional order by one party (the drawer) to another (the drawee) to pay a specified sum of money to a third party (the payee) on demand or at a future date. It is commonly used in international trade to facilitate payments.

Features:

- Unconditional Order: It must be an unconditional order to pay.

- Specific Amount: The amount to be paid must be specified.

- Payment Date: The date of payment must be mentioned or ascertainable.

- Parties Involved: Involves three parties – drawer, drawee, and payee.

Promissory Note:

A promissory note is a financial instrument in which one party (the maker) promises in writing to pay a definite sum of money to another party (the payee) either on demand or at a specified future date.

Features:

- Unconditional Promise: It contains an unconditional promise to pay.

- Specific Amount: The amount to be paid is definite.

- Payment Date: The date of payment can be on demand or at a specified future date.

- Parties Involved: Involves two parties – the maker and the payee.

Both instruments are crucial in financial transactions, providing a formal mechanism for credit and payment assurance.

BLOCK-2 of ECO-02

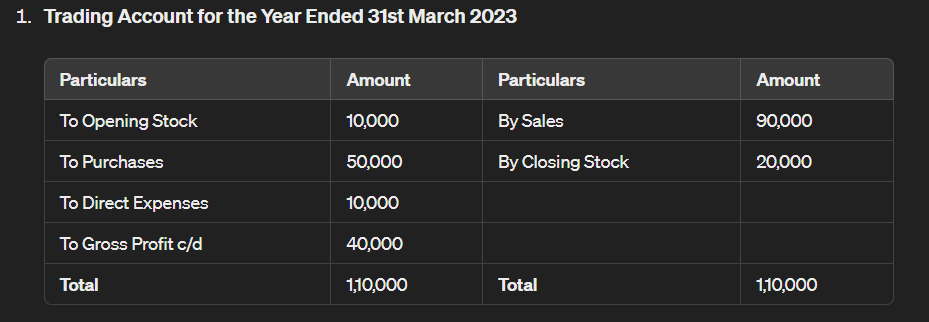

Question 1: Preparing a Trading Profit and Loss Account and a Balance Sheet

Illustration No-8

Step-by-Step Guide:

- Trading Account:

- Opening Stock

- Add: Purchases (minus Purchase Returns)

- Add: Direct Expenses (like wages, carriage inwards)

- Less: Closing Stock

- Gross Profit (Transferred to Profit and Loss Account)

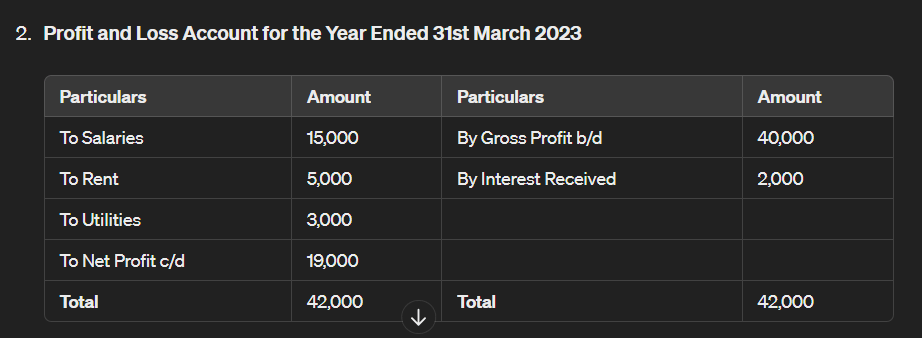

- Profit and Loss Account:

- Gross Profit (brought down from the Trading Account)

- Add: Other Income (e.g., interest received, rent received)

- Less: Indirect Expenses (e.g., salaries, rent, utilities)

- Net Profit (Transferred to the Capital Account)

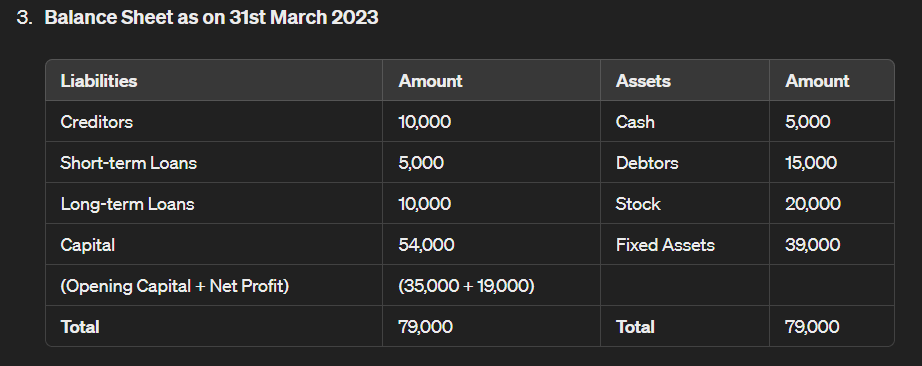

- Balance Sheet:

- Assets:

- Current Assets (e.g., Cash, Debtors, Stock)

- Fixed Assets (e.g., Land, Buildings, Machinery)

- Liabilities:

- Current Liabilities (e.g., Creditors, Short-term Loans)

- Long-term Liabilities (e.g., Mortgage, Long-term Loans)

- Capital:

- Opening Capital

- Add: Net Profit

- Less: Drawings

- Assets:

Example:

Question 2: Provision for Discount on Debtors and Creditors

Provision for Discount on Debtors:

- Purpose: To estimate the expected discount that will be allowed to debtors.

- Accounting Treatment: It is an expense and is debited to the Profit and Loss account.

Provision for Discount on Creditors:

- Purpose: To estimate the expected discount that will be received from creditors.

- Accounting Treatment: It is an income and is credited to the Profit and Loss account.

Example:

- If the total debtors are $10,000 and the expected discount is 5%, the provision would be $500.

- If the total creditors are $8,000 and the expected discount is 4%, the provision would be $320.

Question 3: Rectification of Errors

Illustration No-1,2

Common Types of Errors:

- Errors of Omission: Entire transaction not recorded.

- Errors of Commission: Wrong amount or wrong account.

- Errors of Principle: Incorrect accounting principle.

- Compensating Errors: Errors that offset each other.

Example Errors and Rectification Entries:

Error 1:

- Error: Purchase of $500 not recorded.

- Rectification Entry:

- Debit Purchases $500

- Credit Creditor $500

Error 2:

- Error: Sales of $200 wrongly entered in the Purchases account.

- Rectification Entry:

- Debit Sales $200

- Credit Purchases $200

Question 3: Suspense Account and Rectification

Illustration No-4

Suspense Account:

- Used when there are discrepancies in the trial balance.

- Temporary account to record unknown transactions.

Example:

- Error: Debit side of trial balance exceeds credit by $300.

- Rectification:

- Create a Suspense Account and credit it by $300.

- Locate the error. Suppose it is found that machinery purchased for $300 was not recorded:

- Debit Machinery $300

- Credit Suspense Account $300

Question 4: Distinction between Capital and Revenue

Capital Expenditure:

- Long-term benefits.

- Examples: Purchase of machinery, building, vehicles.

- Shown in the balance sheet as assets.

Revenue Expenditure:

- Short-term benefits.

- Examples: Salaries, rent, utilities.

- Charged to the profit and loss account.

Key Differences:

- Nature: Capital expenditure creates an asset, whereas revenue expenditure is consumed within the accounting period.

- Effect on Profit: Capital expenditure is not immediately charged against profits; revenue expenditure is.

- Financial Statements: Capital expenditures appear on the balance sheet; revenue expenditures appear on the income statement.

Summary

This comprehensive guide should help you understand the preparation of a Trading Profit and Loss account, balance sheet, provisions for discounts, rectification of errors, and the difference between capital and revenue expenditures. Each section provides clear examples and steps to follow.

BLOCK-3 of ECO-02

Ques. 1: Distinction between Sale and Consignment

Sale:

- Ownership Transfer: In a sale, the ownership of goods is transferred from the seller to the buyer.

- Risk and Reward: The risk and reward of ownership pass to the buyer upon the sale.

- Consideration: The seller receives consideration (payment) for the goods sold.

- Relationship: The relationship ends after the sale is completed, unless there are issues like returns or warranty claims.

- Account Recording: Sales are recorded as revenue in the seller’s books immediately upon the transaction.

Consignment:

- Ownership Transfer: In consignment, the ownership of goods remains with the consignor (owner) until the goods are sold by the consignee.

- Risk and Reward: The risk and reward of ownership remain with the consignor until the sale is made by the consignee.

- Consideration: The consignor receives consideration only after the goods are sold by the consignee.

- Relationship: The consignor and consignee maintain an ongoing relationship where the consignee acts as an agent to sell goods on behalf of the consignor.

- Account Recording: In the books of the consignor, the goods sent on consignment are recorded as “Goods Sent on Consignment” rather than sales.

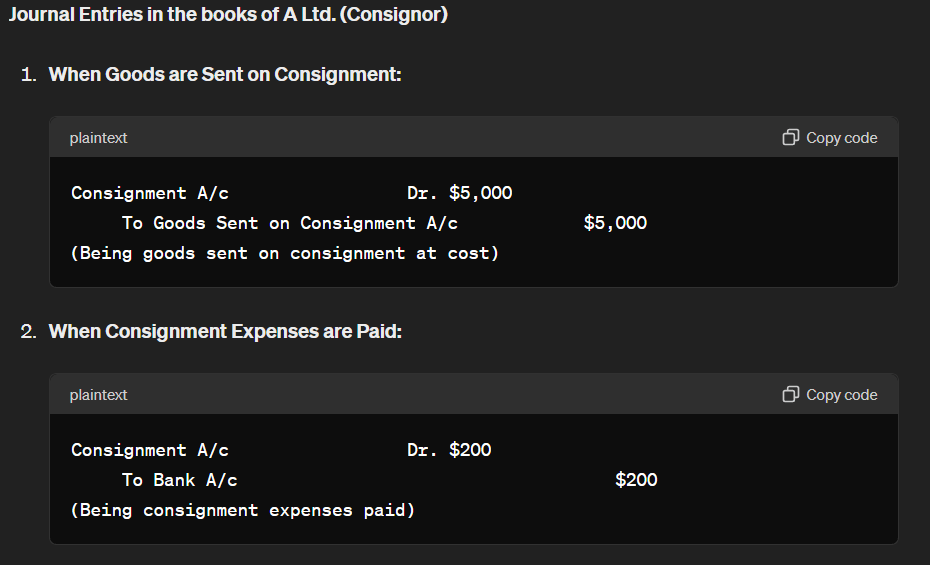

Books of Consignors – Illustration No. 3

Assume the following:

- Consignor: A Ltd.

- Consignee: B Ltd.

- Goods sent on consignment: 100 units @ $50 each.

- Consignment expenses: $200.

- Goods sold by consignee: 80 units @ $70 each.

- Commission to consignee: 10% on sales.

Journal Entries in the books of A Ltd. (Consignor)

Consignment Account:

| Particulars | Amount | Particulars | Amount |

|---|---|---|---|

| To Goods Sent on Consignment | $5,000 | By Bank (Sales) | $5,600 |

| To Bank (Expenses) | $200 | By Commission | $560 |

| To Profit and Loss A/c (Profit) | $400 | ||

| Total | $5,600 | Total | $5,600 |

Ques. 2: What is Joint Venture and Partnership?

Joint Venture:

- Definition: A joint venture is a temporary partnership between two or more parties who come together for a specific business project or purpose. It is limited to a single venture or a defined project.

- Duration: Usually for a short period until the completion of the project.

- Legal Entity: Does not create a new legal entity; the venture operates in the names of the partners involved.

- Profit Sharing: Profits and losses are shared as per the agreement between the parties.

Partnership:

- Definition: A partnership is a formal arrangement between two or more individuals to manage and operate a business and share its profits.

- Duration: Generally long-term, not limited to a single project.

- Legal Entity: Creates a separate legal entity under the partnership agreement.

- Profit Sharing: Profits and losses are shared according to the partnership agreement.

Prepare a Joint Venture Account – Illustration No. 1

Assume the following:

- Venturers: X and Y

- X and Y agree to share profits and losses equally.

- X contributes cash: $5,000

- Y contributes cash: $3,000

- Expenses paid by X: $1,000

- Expenses paid by Y: $500

- Sales proceeds: $10,000

Journal Entries:

Joint Venture Account:

| Particulars | Amount | Particulars | Amount |

|---|---|---|---|

| To X’s Capital A/c (Cash) | $5,000 | By Bank (Sales) | $10,000 |

| To Y’s Capital A/c (Cash) | $3,000 | By X’s Capital A/c (Expenses) | $1,000 |

| To X’s Capital A/c (Expenses) | $1,000 | By Y’s Capital A/c (Expenses) | $500 |

| To Y’s Capital A/c (Expenses) | $500 | By X’s Capital A/c (Profit) | $4,250 |

| By Y’s Capital A/c (Profit) | $4,250 | ||

| Total | $9,500 | Total | $10,000 |

The Joint Venture account is closed by transferring the profit to the capital accounts of X and Y in their agreed profit-sharing ratio.

BLOCK-4 of ECO-02

Ques. 1: Self-Balancing System and Sectional Balancing

Self-Balancing System

A self-balancing system is an accounting system where separate sets of books are maintained for different segments or branches of a business, each of which can independently balance itself. This means each segment’s or branch’s ledger is complete with its own set of accounts, including both debits and credits, such that the total debits equal the total credits within that segment.

Advantages of a Self-Balancing System:

- Error Detection: It is easier to detect errors since each segment balances independently.

- Decentralized Accounting: Facilitates decentralized accounting, allowing different branches or departments to maintain their own records.

- Efficient Reconciliation: Simplifies reconciliation, as errors are isolated within individual segments rather than affecting the entire ledger.

- Better Control: Enhances control and accountability, as each segment is responsible for maintaining its own balanced accounts.

- Improved Decision Making: Provides detailed information for each segment, aiding in better decision-making and performance evaluation.

Sectional Balancing

Sectional balancing is an accounting system where different sections of the ledger (like sales ledger, purchase ledger, and general ledger) are maintained separately, but each section is balanced with control accounts. Control accounts summarize the transactions in each section, ensuring the overall balance of the ledger.

How Sectional Balancing Works:

- Sales Ledger Control Account: Summarizes all transactions related to receivables.

- Purchase Ledger Control Account: Summarizes all transactions related to payables.

- General Ledger: Maintains overall financial information, including the summarized totals from the control accounts.

Advantages of Sectional Balancing:

- Simplified Ledger: Reduces the complexity of the general ledger by summarizing detailed transactions in control accounts.

- Ease of Reconciliation: Makes it easier to reconcile individual ledgers with the general ledger.

- Error Isolation: Helps in isolating errors within specific sections, making error detection and correction more efficient.

- Detailed Analysis: Allows for detailed analysis of specific areas, such as receivables and payables, without cluttering the general ledger.

Ques. 2: Disadvantages of a Single Entry System

A single entry system is a simplified form of accounting where only one entry is made for each transaction, as opposed to the double entry system which requires corresponding debit and credit entries. This system is often used by small businesses due to its simplicity and lower cost.

Disadvantages of a Single Entry System:

- Incomplete Records: Lacks comprehensive records, as it does not account for all aspects of a transaction (debits and credits).

- Error Detection: Difficulty in detecting and correcting errors, since there is no built-in method to ensure that debits equal credits.

- Limited Financial Information: Provides limited financial information, which can impede effective financial analysis and decision-making.

- Lack of Standardization: Often lacks standardization, making it harder to compare financial performance over time or with other businesses.

- Auditing Difficulties: Difficult to audit, as the records are not as detailed or systematic as those in a double entry system.

- Financial Control: Offers poor financial control and oversight, increasing the risk of fraud and mismanagement.

- Inaccurate Financial Statements: Can lead to inaccurate financial statements, as the system does not provide a complete picture of the business’s financial position.

- Tax Compliance Issues: May cause issues with tax compliance, as detailed and accurate financial records are often required by tax authorities.

These limitations make the single entry system unsuitable for larger or more complex businesses, which require more robust and detailed accounting practices to manage their financial affairs effectively.

BLOCK-5 of ECO-02

Ques. 1: Receipts and Payment Accounts and Income and Expenditure Accounts

Receipts and Payment Account: A Receipts and Payment Account is a summary of cash transactions over a specific period, usually a financial year. It records all cash receipts and cash payments irrespective of whether they are capital or revenue in nature. It is similar to a cash book but summarized. The primary characteristics of this account are:

- It is a real account and includes all cash and bank transactions.

- It is prepared on a cash basis.

- It shows the opening and closing balance of cash and bank.

- It includes both capital and revenue receipts and payments.

Income and Expenditure Account: An Income and Expenditure Account is akin to a Profit and Loss Account prepared by non-profit organizations. It shows the revenue income and revenue expenditure for a particular period, thereby revealing the surplus or deficit for that period. Key points include:

- It is a nominal account and includes only revenue items.

- It is prepared on an accrual basis.

- It does not show cash and bank balances.

- It includes adjustments for outstanding expenses, prepaid expenses, accrued income, and income received in advance.

Illustration No. 5: Assume the following data for illustration:

- Receipts include donations, membership fees, and grants.

- Payments include salaries, office expenses, and utility bills.

Receipts and Payment Account:

| Receipts | Amount | Payments | Amount |

|---|---|---|---|

| Opening Balance (Cash) | 10,000 | Salaries | 5,000 |

| Donations | 20,000 | Office Expenses | 3,000 |

| Membership Fees | 15,000 | Utility Bills | 2,000 |

| Grants | 10,000 | Purchase of Equipment | 8,000 |

| Closing Balance (Cash) | 37,000 | ||

| Total | 55,000 | Total | 55,000 |

Income and Expenditure Account:

| Income | Amount | Expenditure | Amount |

|---|---|---|---|

| Membership Fees | 15,000 | Salaries | 5,000 |

| Donations | 20,000 | Office Expenses | 3,000 |

| Grants (Revenue part) | 10,000 | Utility Bills | 2,000 |

| Surplus (Balancing Fig.) | 5,000 | ||

| Total | 50,000 | Total | 50,000 |

Ques. 2: What is Depreciation?

Depreciation: Depreciation is the systematic allocation of the cost of a tangible asset over its useful life. It accounts for the reduction in the value of the asset due to wear and tear, usage, or obsolescence.

Methods of Depreciation:

- Straight Line Method (SLM): The cost of the asset is spread evenly over its useful life.

- Reducing Balance Method (RBM): Depreciation is calculated as a fixed percentage of the book value of the asset each year.

- Units of Production Method: Depreciation is based on the usage or output of the asset.

- Sum of the Years’ Digits Method: Depreciation is accelerated, with higher amounts in the earlier years of the asset’s life.

Illustration No. 2: Assume a machine costing $10,000 with a residual value of $1,000 and a useful life of 3 years. Using the Straight Line Method:

Calculation:

- Depreciable Amount = Cost – Residual Value = $10,000 – $1,000 = $9,000

- Annual Depreciation = Depreciable Amount / Useful Life = $9,000 / 3 = $3,000

Machinery Account for 3 Years:

| Date | Particulars | Debit | Credit | Balance |

|---|---|---|---|---|

| 01/01/20X1 | To Bank (Purchase) | 10,000 | 10,000 | |

| 31/12/20X1 | By Depreciation | 3,000 | 7,000 | |

| 31/12/20X2 | By Depreciation | 3,000 | 4,000 | |

| 31/12/20X3 | By Depreciation | 3,000 | 1,000 |

Ques. 3: Distinction between Provision and Reserve

Provision:

- Purpose: Provisions are created to cover a known liability or a probable future loss.

- Nature: They are a charge against profit and are mandatory.

- Usage: They are used to meet specific liabilities, such as bad debts or depreciation.

- Impact on Profit: Provisions reduce the profit of the period in which they are created.

Reserve:

- Purpose: Reserves are created to strengthen the financial position of the business and to meet future contingencies.

- Nature: They are an appropriation of profit and not mandatory unless specified by law.

- Usage: They can be used for various purposes, such as expansion, dividend distribution, or contingencies.

- Impact on Profit: Reserves do not reduce the profit of the period in which they are created but rather allocate part of the profit for future use.

Example:

- Provision: Bad Debt Provision, Provision for Depreciation

- Reserve: General Reserve, Capital Reserve, Revenue Reserve

This comprehensive overview provides the fundamental concepts and illustrative examples related to the accounting topics mentioned.

Download PDF Of Above Content In 3 Paper

Conclusion:

With these IGNOU ECO-02 BCA short notes, you’ll be well-equipped to tackle your exams with confidence. Remember to complement your study efforts with regular practice and mock tests. Good luck!

[…] Read More: ECO-02(ACCOUNTANCY) Important Short Notes| Expected Question |IGNOU BCA| […]