12 % club proves to be a game-changer in the peer-to-peer lending sector in a world where digital innovation is challenging established financial institutions. This platform, powered by BharatPe in partnership with RBI-approved NBFCs, offers a distinctive combination of lending facilities and investing possibilities, with the potential for up to 12% daily returns.

Table of Contents

The 12 % club is leading the way in this transformation of established financial paradigms due to its creative approach to lending and borrowing, which opens doors to stability and financial growth. Whether you’re a borrower in need of funding or an investor looking for big profits, the 12 % club offers an excellent opportunity to successfully and confidently manage a shifting financial landscape.

Is BharatPe's P2P 12 % club safe?

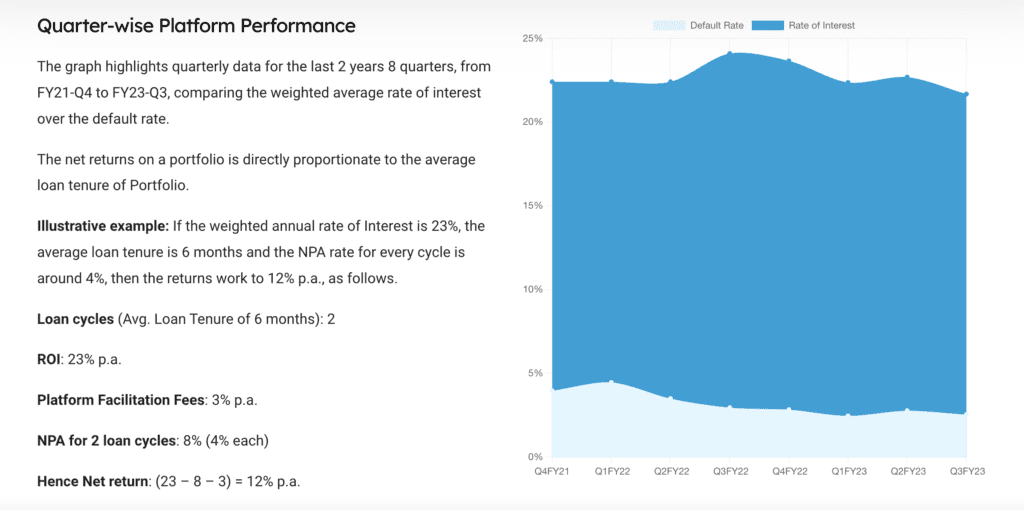

Yes, It is safe to invest in 12 % club, it is expected to produce returns of 12%, according to data from BharatPe. there is none case of investors earning less throughout the club’s three years of operation have been recorded. The platform attempts to manage risks through payment control for a large number of merchants and improved underwriting methods, which assist lower the risks associated with borrower defaults.

In order to reduce the effect of borrower defaults on investor returns, individual investments are further spread among a number of smaller loans.

The platform uses a peer-to-peer lending concept where each investor’s money is split into hundreds of microloans, restricting the impact of individual borrower defaults on total profits. Investors can withdraw both their principal and interest without a lock-in period.

The platform argues that default rates are low, less than 3%, and that dangers occur only if a considerable share (30-35%) of borrowers default completely, which has never exceeded 5% in their history.

To summarize, while BharatPe’s P2P 12% Club presents an opportunity for potentially large returns, investors should be mindful of the related risks, including the possibility of borrower failure. Before making any investment decisions, it is advised that anyone thinking about investing on this platform carefully read the terms and conditions listed on the app and determine how much risk they can handle.

Below example will also help you understand how you will eventually get 12% returns

how to register and invest in 12 % club ?

To register for the 12% club, follow these steps:

- Download the 12 % club app from the Google Play Store or Apple App Store.

- Open the app and enter your mobile number. Confirm it using the OTP (One-Time Password) sent to your phone.

- You will be redirected to the app's dashboard.

- Start investing in the 12 % club app by selecting the "contribute money" option.

- Link your bank account by clicking on "Link Now" and selecting your bank account from the drop-down menu.

- Validate your Aadhaar using an OTP.

- Submit your Selfie after completing your Aadhaar KYC.

- Agree to all the terms and conditions, and your account will be authorized.

- Now you can start earning up to 12% interest on your money by adding it to your account.

Note: Remember to complete your KYC (Know Your Customer) process before investing. You can start investing with as little as Rs 1000 and as much as Rs 10 lakhs

how 12 % club app makes money ?

The 12 % club app produces revenue through a peer-to-peer lending strategy that allows investors to lend money to BharatPe’s P2P NBFC partners. Following that, these NBFCs lend money to customers at a 12% interest rate, enabling investors to make up to 12% percent on their capital.

The platform offers this investment and borrowing product in partnership with RBI-approved NBFCs, guaranteeing that investors receive daily interest credits in their accounts and have the flexibility to withdraw money whenever they choose.

Has anyone lost the money that is deposited in the 12 % Club app by BharatPe?

No, there is no cases of investors earning less throughout the club’s three years of operation have been recorded. There are differing viewpoints on the safety of money put in BharatPe’s 12 % club app. While some investors have reported success with strong returns on their investments, others have expressed worries and cautions about the hazards involved in investing in these platforms.

It is critical to emphasize that peer-to-peer lending, such as that provided by the 12 % club app, entails inherent risks, including the chance of borrower defaults affecting investor profits. By spreading investments among several smaller loans and collaborating with RBI-approved NBFCs to offer lending and investing products, the platform seeks to reduce these risks.

Even though there have been examples of people investing in the 12 % club app and seeing returns, it is imperative that potential investors carefully consider their risk tolerance and read the terms and conditions of the platform before making a deposit. There are risks associated with investing, just as with any opportunity, so people should proceed with caution and do extensive study before deciding what to invest in.

how to earn money from 12 % club by Referring ?

The 12 % club app provides a “Refer & Earn” feature, which allows users to earn money by referring friends and family. A unique URL can be shared, and if someone uses it to download the app and invest, the referrer will receive 10% of the new user’s investment. With the help of this referral program, users can utilize the app to get extra money.

12 % club Features that you should know before investing

-The 12% Club provides a guaranteed annual interest rate of 12%, which is significantly greater than other investment options on the market.

-The 12% Club allows customers to participate for periods ranging from three months to one year.

-Investing in the 12% Club is simple and may be done using BharatPe’s website or mobile app.

-There is no maximum investment limit for the 12% Club.

12 % club Advantages that you should know before investing

-The 12% Club provides a high rate of return when compared to other investing options on the market.

-The 12% Club’s interest rate is guaranteed, ensuring that investors receive a fixed return on their investment.

-Investing in the 12% Club is simple and may be done using BharatPe’s website or mobile app.

-Investing in the 12% Club can help diversify your financial portfolio and reduce risk.

12 % club Disadvantages that you should know before investing

-The 12% Club provides only one investment choice, which may not be suitable for all investors.

-Since the 12% Club is a fixed-term investment, investors may not be able to access their funds until the conclusion of the term.

-The 12% Club invests in loans made to small and medium-sized firms, which have a higher chance of default.

-The 12% Club is not covered by any deposit insurance plan, which means that investors may lose money if BharatPe fails to return the loans.

Minimum investment from where you can start investing

The 12 Percent Club requires a minimum involvement of Rs. 1,000, making it accessible to a wide variety of individuals. This is especially helpful for people who are new to investing and wish to begin with a small sum.

However, it is crucial to remember that the large minimum investment may be a barrier for some individuals who want to invest smaller amounts.

For more Queries You can contact Customer care of 12 % club

BharatPe provides customer service through a variety of channels, including email and phone. They also offer a dedicated support team ready to answer any questions or issues investors may have.

However, some investors have claimed problems with customer service, particularly during periods of high demand or technological challenges. This can be a drawback for people who need immediate and efficient assistance.

Nodal officer details

Phone

Timings for contact

12 % club Review?

Regarding the 12 % club app by BharatPe’s efficacy and safety as an investment platform, opinions have been mixed. Below is an overview of the main ideas from a number of sources:

- Platform Overview: BharatPe powers The 12 % club, a technology-driven application for borrowing and lending money. It provides NBFCs with sourcing and technological support while giving investors the chance to get up to 12% returns on their capital.

- Risks: Because peer-to-peer lending is unsecured, investing in the 12 % club involves certain inherent risks. Despite having a gentle recovery and collection procedure in place to reduce defaults, the platform does not promise risk-free returns or the absence of defaults.

- Investment Process: Investors can create an account on the 12 % club by updating their KYC details. They can then add money to their account using UPI, Debit Card, or Net Banking to start earning returns on their investments, which are based on deployment with registered borrowers through the P2P NBFC Partner.

12 % club User Experiences:

Positive

Positive user experiences include daily earnings, simple deposit and withdrawal procedures, and the opportunity to earn up to 12% return on deposits, according to some users.

Mixed

Due to the inherent dangers involved in these kinds of investments, some voices of caution advise investors to exercise caution and only make investments they can afford to lose.

Ashneer Grover (Former managing director of BharatPe)

Ashneer Grover issued statements cautioning about the reality of peer-to-peer (P2P) lending and raising concerns about the 12 % club app.

Ashneer Grover's comments and tweets have triggered responses and discussions on social media platforms like X (Former Twitter).

He tweet That "Bharatpe will shutdown /sold in fire sale overnight like svb. people who have been asking me whether they should keep money in 12 % club - don't take that risk anymore i know they've sold their loan book worth Rs. 100 cr. to ARCS for pennies - booking huge losses. the only business anyone should do with Bharatpe is take a loan from them".

+ There are no comments

Add yours